Retirement Planning

Gold Coast

Why Retirement Planning

is Essential

Planning for retirement goes beyond simply saving; it requires understanding your lifestyle goals, managing investments, and preparing for unexpected costs. Without a well-structured retirement plan, individuals risk outliving their savings, facing potential lifestyle changes, and even sacrificing financial independence. Our Gold Coast retirement planners work closely with you to create a sustainable financial roadmap, ensuring your retirement years are comfortable and worry-free.

It is never too early to start planning for your retirement.

The earlier you take action on your retirement planning, the higher the likelihood of enjoying the retirement you want.

Putting in the correct plan, no matter your age, can make an enormous difference to the quality of your life throughout retirement. Your “future-self” will thank you for the changes you make today.

So how much will you need for retirement and how long will it last?

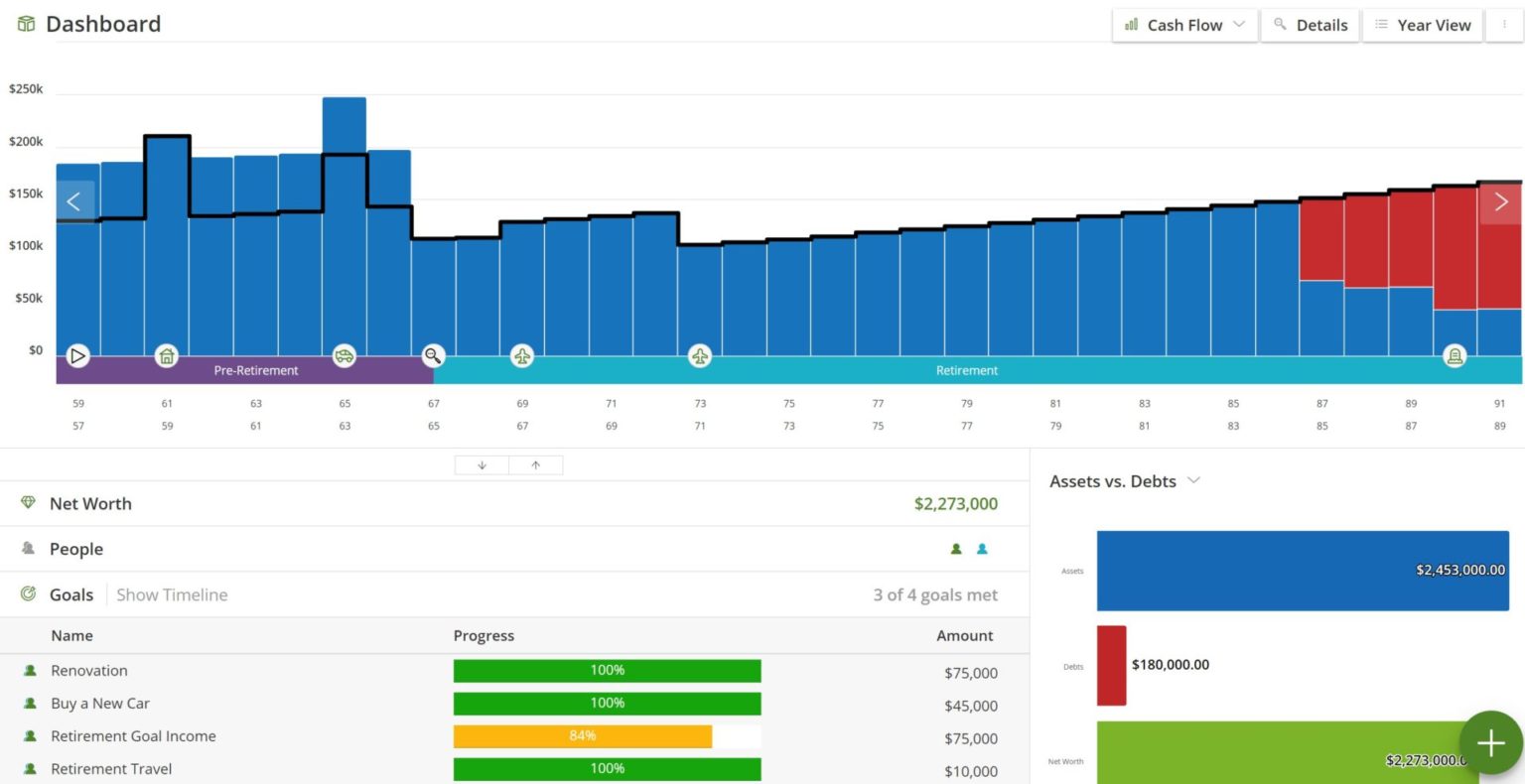

These are questions that we can answer for you. By understanding your situation and needs, we can model your current trajectory so you know your financial future. The actual amount you need depends on your lifestyle aspirations, retirement length, and investment returns.

For example, to provide an income of $70,000 a year, you’ll potentially need to accumulate a retirement lump sum of around $690,000 for 25 years. Assuming a return of 7.5% per annum after fees and inflation of 2.5% (note: age pension entitlements may be included).

Is this enough? For a modest retirement, it is suggested the average 65 y.o Australian needs at least:

- $46,620 per annum for couples

- $32,417 per annum for singles

For a comfortable retirement, it is suggested the average 65 y.o Australian needs at least:

- $71,723 per annum for couples

- $50,981 per annum for singles

Our Gold Coast Retirement Planning Services

Transition to retirement strategies

A transition to retirement (TTR) strategy can help you ease into retirement by accessing part of your superannuation as an income stream while continuing to work. This approach offers flexibility, allowing you to reduce work hours without compromising income or boost your retirement savings by reinvesting the accessed funds into super. Our tailored TTR strategies consider your current income, super balance, and retirement goals, ensuring a smooth transition with financial stability.

Downsizer Contributions

If you’re over 55, the downsizer contribution allows you to contribute proceeds from selling your primary residence into your superannuation. This approach can increase your retirement savings and potentially improve your financial security in retirement. We can guide you through eligibility requirements, contribution limits, and the potential tax implications to optimise this strategy for your retirement plan.

Tax effective Superannuation contribution strategies

Maximizing tax-effective super contributions, such as concessional and non-concessional contributions, can significantly boost your retirement savings. We offer strategic advice on using salary sacrifice, personal deductible contributions, and spouse contributions, helping to minimise tax while growing your retirement nest egg. Our guidance aligns with current tax laws and considers your long-term financial goals.

Cash flow and debt management

Effective cash flow and debt management are essential for a financially secure retirement. We can provide strategies to manage your income, reduce debt, and balance expenses with retirement savings goals. Our approach focuses on minimizing financial strain, reducing unnecessary expenses, and ensuring you have sustainable cash flow, helping to create a debt-free and stress-free retirement.

Account-based pension advice

An account-based pension allows you to convert your superannuation into a regular income stream, providing a stable income throughout retirement. We offer personalised advice on structuring your account-based pension to maximise tax-free income and manage withdrawals. Our guidance ensures that you receive a regular income while preserving your capital for long-term financial security.

Pension income requirements

Understanding pension income requirements is crucial for meeting your retirement needs without overspending your savings. We analyze your income requirements, factoring in living costs, lifestyle choices, and potential health expenses to determine the optimal income for a comfortable retirement. This approach ensures a steady income while managing your super balance effectively over time.

What’s Our Process?

-

Free Initial Consultation

In our initial complimentary meeting we will listen to your goals and aspirations. We will then cover in detail the services we provide and explain how we help people achieve their goals

-

Research

Utilising our broad knowledge base, and ensuring compliance with relevant rules and regulations, we undertake detailed research to ensure we have considered all aspects of your situation.

-

Strategy

Here we will identify and evaluate a range of strategies based on achieving your goals, and confirm their suitability for best meeting your needs.

-

advice

We will present you with a Clear & Concise plan to achieve the goals that you set out. This will include all the ‘nuts & bolts’ information and the various steps to be taken to meet your goals.

-

implementation

Simple – this step is putting the plan into action.

-

review

We will meet with you AT LEAST once a year to ensure your plan remains relevant and you are still on track to meet your goals.

Secure Your Retirement Future Today!

With the right retirement plan, you can enjoy the financial freedom and peace of mind you deserve in your later years. Ready to take the first step toward a worry-free retirement? Contact New Wave Financial Planning for a consultation and let us help you build a future that aligns with your dreams.

New Wave Financial Planning:

Gold Coast Retirement Planning Experts

Benefits of Working with New Wave Financial Planning:

Personalised Financial Roadmap

Every individual has unique financial needs; our retirement planning experts create a tailored strategy that adapts to your life stages and goals.

Ongoing Support and Adjustments

Life changes, and so should your retirement plan. We offer ongoing support, making necessary adjustments to keep your goals on track.

Trusted and Transparent Advice

Our Gold Coast team is committed to providing advice that is straightforward, transparent, and always in your best interest.