Budgeting & Cash Flow Advice

Gold Coast

Does the word “budget”

give you chills?

Combining technology with experience, the team at New Wave Financial Planning can take the stress out of your budget and cash flow management and put you in control of your finances.

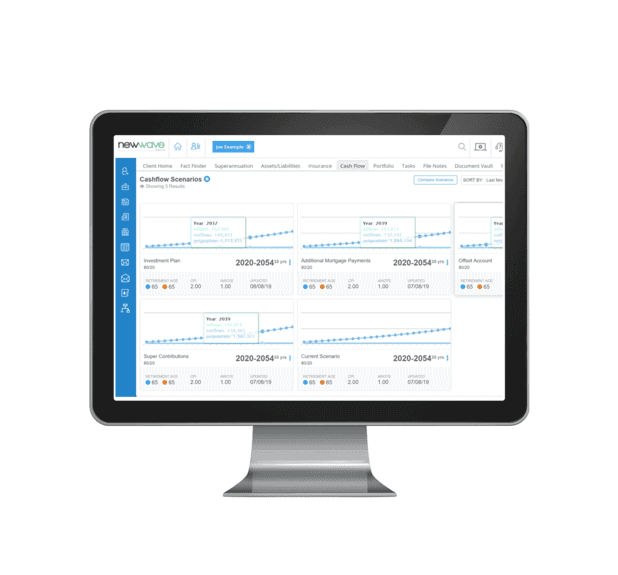

We can help by providing a clear snapshot of where you are and illustrate the path you’re currently on. From there we can then provide alternative scenarios based on simple, but effective changes.

We use cash flow software that data feeds all your financial accounts daily, to provide you clear understanding of your money.

The budgeting process begins by understanding your exact inflows and outflows. Money Smart provides a free budget spreadsheet that can help categorise your finances. Once we have a clear snapshot, we can clarify your goals and design a unique path to illustrate how you can achieve your goals. A clearly defined budget will give you control of your money and allow you to reach the goals you want whether they be:

- Paying down debt

- Being able to holiday regularly

- Save for your first home or investments

- Put money aside for your children

- Or simply build up a cash buffer

Our Gold Coast Budgeting Advice Services

At New Wave Advice, we offer a comprehensive suite of budgeting services designed to meet your individual needs. Whether you’re looking to save for a significant purchase, pay off debt, or plan for retirement, our advisors provide the support and tools you need.

Personal Budget Creation

We work closely with you to create a personalised budget that reflects your income, expenses, and financial goals. Our structured approach ensures that your budget is realistic, achievable, and tailored to your lifestyle.

Expense Tracking and Management

Understanding where your money goes is crucial for effective budgeting. Our team provides tools and strategies for tracking your expenses, helping you identify areas where you can cut back and save more.

Debt Reduction Strategies

If debt is weighing you down, we offer targeted advice on reducing and managing your debt effectively. We help you develop a repayment plan that prioritises high-interest debts while ensuring your budgeting goals remain achievable.

Savings and Investment Planning

Saving is an essential part of budgeting. We provide guidance on how to incorporate savings into your budget, including strategies for building an emergency fund and planning for future investments that align with your financial aspirations.

Financial Goal Setting

Setting clear financial goals is vital for effective budgeting. Our advisors assist you in establishing both short- and long-term goals, ensuring your budget aligns with your objectives, whether it’s buying a home, funding education, or planning for retirement.

Ongoing Budget Reviews and Adjustments

Your financial situation may change, and your budget should evolve with it. We offer regular budget reviews to assess your progress and make necessary adjustments, keeping you on track to achieve your financial goals.

What’s Our Process?

-

Free Initial Consultation

In our initial complimentary meeting we will listen to your goals and aspirations. We will then cover in detail the services we provide and explain how we help people achieve their goals

-

Research

Utilising our broad knowledge base, and ensuring compliance with relevant rules and regulations, we undertake detailed research to ensure we have considered all aspects of your situation.

-

Strategy

Here we will identify and evaluate a range of strategies based on achieving your goals, and confirm their suitability for best meeting your needs.

-

advice

We will present you with a Clear & Concise plan to achieve the goals that you set out. This will include all the ‘nuts & bolts’ information and the various steps to be taken to meet your goals.

-

implementation

Simple – this step is putting the plan into action.

-

review

We will meet with you AT LEAST once a year to ensure your plan remains relevant and you are still on track to meet your goals.

Take Control of Your Finances with Our Budgeting Advice Gold Coast Service

Achieving financial stability starts with effective budgeting. Ready to take control of your financial future? Contact New Wave Financial Planning for a consultation, and let our Gold Coast budgeting advisors provide you with the support you need to achieve your financial goals.

Why Choose New Wave

Financial Planning for Budgeting Advice on the Gold Coast

Benefits of Working with New Wave Financial Planning:

Expertise in Financial Management

Our advisors possess extensive knowledge in budgeting and financial planning, providing you with the insights needed to make informed decisions.

Tailored Support for Your Needs

We understand that everyone’s financial situation is unique; our personalised approach ensures that your budgeting advice is relevant and effective.

Transparent and Trustworthy Guidance

Integrity and transparency are at the heart of our service. We provide clear, honest budgeting advice, helping you navigate your financial journey with confidence.